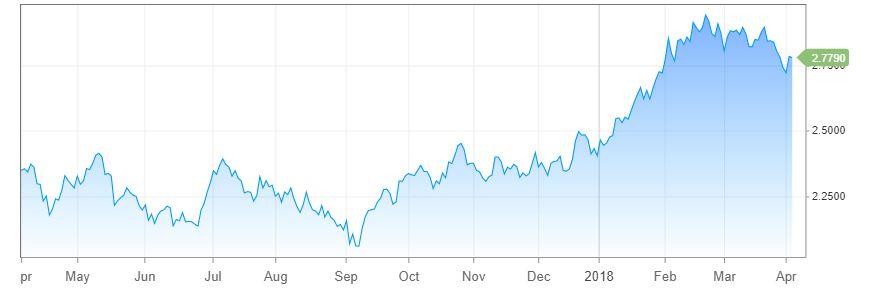

10 Year Bond Chart April 2018

Credit spreads are widening, and while this may not be a five-alarm fire yet, it's a potential flare being set off for commercial mortgage rates. Widening credit spreads still act as a leading indicator for asset prices and are a signal worthy of attention. The solace in this, for the time being, is that tariff chatter from both the US and China have the 10 year treasury in a stalemate. Good news for those locking in a rate over the last two weeks.

The yields on a 2-year to 10-year are compressing, The market is basically anticipating a slowdown in economic growth, rather than expansion in economic growth. All of those factors should be considered by investors when determining how quickly they are going to buy another asset or refinance. As much as this paints a picture of uncertainty, timing has remained excellent to finance commercial real estate.

When spreads widen out lenders are a taking a stance by tightening loan requirements. Most importantly, the US real estate investors already have a huge amount of leverage in the system. When rates move higher, and especially if spreads widen out, people have to unwind some of that leverage when selling to accommodate higher all in rates for financing commercial properties.

Credit spreads widen when U.S. Treasury markets are favored over corporate bonds, typically in times of uncertainty or when economic conditions are expected to deteriorate. The spread measures the difference in yield between U.S. Treasury bonds and other debt securities of lesser quality, such as corporate bonds.